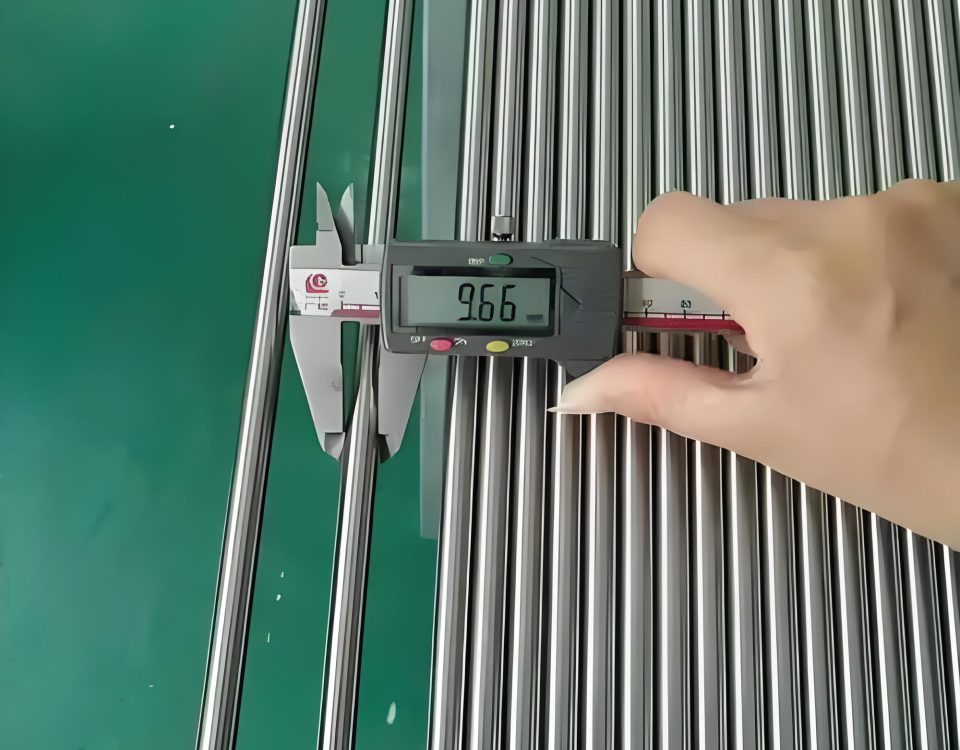

EN 10305 Cold Drawn Precision Seamless Steel Pipe

July 9, 2024

Grade 6 Ti-5Al-2.5Sn Titanium Pipe

July 20, 2024Oil Country Tubular Goods (OCTG) Industry Forecast and Potential Opportunities Analysis by 2023

Executive Summary

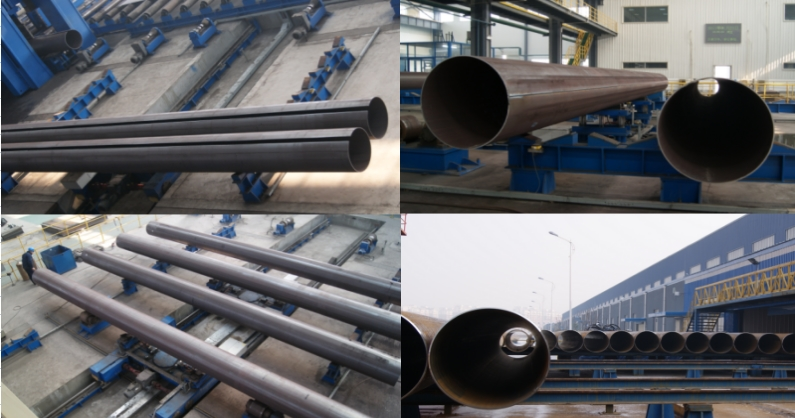

The Oil Country Tubular Goods (OCTG) industry is integral to the oil and gas sector, encompassing a range of products such as casing, tubing, and drill pipe used in the drilling and production of oil and gas. As the global energy landscape evolves, the OCTG market faces both challenges and opportunities driven by technological advancements, geopolitical shifts, and environmental considerations. This report provides a detailed forecast and analysis of the OCTG industry through 2023, highlighting key market drivers, challenges, segmentation, and potential growth areas.

Market Overview

Market Size and Growth

The global OCTG market is projected to grow significantly, driven by increased exploration and production activities, particularly in unconventional resources such as shale gas and tight oil. According to industry reports, the OCTG market size was valued at approximately $50 billion in 2020 and is expected to reach $60 billion by 2023, growing at a CAGR of 20%.

Key Market Drivers

- Rising Global Energy Demand:

- The International Energy Agency (IEA) forecasts a steady increase in global energy demand, particularly in emerging economies like China and India. This surge in demand necessitates expanded oil and gas exploration, driving the need for OCTG.

- Energy consumption is projected to grow by 1.3% annually, with fossil fuels remaining a significant part of the energy mix.

- Technological Advancements:

- Innovations in drilling technologies, such as horizontal drilling and hydraulic fracturing, have revolutionized the extraction of oil and gas from unconventional resources. These technologies require high-quality OCTG to ensure operational efficiency and safety.

- Enhanced Oil Recovery (EOR) techniques and the development of smart tubular goods with embedded sensors for real-time monitoring are expected to further boost the demand for advanced OCTG products.

- Increased Exploration and Production Investments:

- Major oil and gas companies are ramping up investments in exploration and production (E&P) activities, particularly in offshore and deepwater projects. The Gulf of Mexico, Brazil, and West Africa are notable regions with significant investment prospects.

- According to Rystad Energy, global upstream investments are expected to increase by 8% annually, reaching $X trillion by 2023.

- Geopolitical Stability and Regulatory Support:

- Political stability and supportive regulatory frameworks in key oil-producing regions enhance the attractiveness of E&P activities, thereby driving the demand for OCTG.

- For instance, the U.S. government’s policies aimed at achieving energy independence have spurred domestic drilling activities, benefitting the OCTG market.

Market Challenges

- Volatile Oil Prices:

- Fluctuations in oil prices create uncertainty in investment and production decisions, impacting the demand for OCTG. The oil price volatility experienced during the COVID-19 pandemic highlighted the sensitivity of the market to external shocks.

- Brent crude oil prices are expected to range between $80 and $90 per barrel through 2023, with potential disruptions affecting market dynamics.

- Environmental Regulations and Shift to Renewables:

- Increasingly stringent environmental regulations and the global shift towards renewable energy sources present long-term challenges to the OCTG market. Policies aimed at reducing carbon emissions and promoting renewable energy can limit investments in new oil and gas projects.

- The European Union’s Green Deal and the U.S. rejoining the Paris Agreement are examples of regulatory shifts impacting the traditional hydrocarbon industry.

- Supply Chain Disruptions:

- The ongoing impact of global supply chain disruptions, exacerbated by the COVID-19 pandemic, affects the availability and cost of raw materials and finished OCTG products. Trade tensions and logistical challenges further contribute to supply chain instability.

- The cost of steel, a primary material for OCTG, has seen significant fluctuations, impacting production costs and pricing strategies.

Market Segmentation

By Product Type

- Casing:

- Casing is used to line the borehole of a well, providing structural integrity and preventing contamination from surrounding formations. It is categorized into conductor casing, surface casing, intermediate casing, and production casing, each serving specific functions.

- The demand for casing is driven by the number of new wells drilled and the complexity of drilling operations.

- Tubing:

- Tubing transports oil and gas from the wellbore to the surface. It must withstand high pressures and corrosive environments, often requiring specialized coatings and materials.

- The tubing market is segmented into standard tubing and coiled tubing, with applications in both conventional and unconventional wells.

- Drill Pipe:

- Drill pipes are critical in the drilling process, transmitting torque to the drill bit and circulating drilling fluid. They must be durable to withstand the mechanical stress of drilling operations and the harsh downhole conditions.

- Drill pipe demand is closely linked to drilling activity levels and the number of active rigs. The global rig count serves as a key indicator for drill pipe demand.

By Grade

- API Grade:

- Standardized grades according to the American Petroleum Institute (API) specifications. Common grades include J55, K55, N80, L80, P110, and Q125, each suited for different well conditions.

- API grades ensure a minimum level of quality and performance, making them widely used in the industry for standard applications.

- Premium Grade:

- Higher performance and more specialized grades designed for challenging drilling and production environments. These include sour service grades, high collapse grades, and high-strength grades.

- Premium grades offer enhanced mechanical properties, corrosion resistance, and fatigue resistance, suitable for complex and extreme conditions such as deepwater drilling and high-pressure, high-temperature (HPHT) environments.

By Region

- North America:

- North America is expected to dominate the OCTG market due to significant growth driven by shale developments and offshore projects in the Gulf of Mexico. The U.S. shale revolution continues to be a major driver for OCTG demand.

- Canada also contributes significantly with its substantial oil sands reserves and ongoing exploration activities. The region benefits from advanced technological adoption and favorable regulatory conditions.

- Middle East and Africa:

- As a major oil-producing region, the Middle East remains a key market for OCTG. Countries like Saudi Arabia, UAE, and Iraq are investing heavily in expanding their oil production capacities.

- Africa, particularly West Africa, is witnessing increased exploration activities, with significant investments in offshore projects. Nigeria and Angola are notable contributors to the regional OCTG demand.

- Asia-Pacific:

- The Asia-Pacific region is experiencing growing energy demand and increasing investments in oil and gas infrastructure. Countries like China, India, and Indonesia are expanding their exploration and production activities.

- The region’s focus on achieving energy security and reducing dependence on imports drives the demand for OCTG products.

- Europe:

- Europe, with its focus on offshore projects and technological advancements in drilling techniques, presents significant opportunities for the OCTG market. The North Sea remains an important area for exploration and production.

- Regulatory frameworks supporting domestic energy production and reducing reliance on external sources further drive the market.

- Latin America:

- Latin America is expanding exploration activities, particularly in Brazil and Argentina. Brazil’s pre-salt fields and Argentina’s Vaca Muerta shale formation are key drivers of OCTG demand in the region.

- The region benefits from favorable geological prospects and increasing investments in oil and gas infrastructure.

Market Forecast

Global OCTG Market Size (2023)

- The global OCTG market size is projected to reach $60 billion by 2023, growing at a CAGR of 30% from 2020 to 2023.

- North America is expected to continue its dominance in the market, followed by the Middle East and Africa. The Asia-Pacific region is also anticipated to show significant growth.

Key Trends

- Digitalization and Automation:

- The adoption of digital technologies and automation is transforming the OCTG industry. Real-time data analytics, predictive maintenance, and automated drilling processes enhance operational efficiency and reduce costs.

- Smart tubular goods with embedded sensors provide real-time monitoring of well conditions, improving safety and performance.

- Sustainability Initiatives:

- There is an increased focus on sustainable practices and reducing the carbon footprint of oil and gas operations. Companies are investing in technologies that minimize environmental impact and promote energy efficiency.

- The development of eco-friendly coatings and materials for OCTG products is gaining traction.

- Strategic Partnerships:

- Collaboration among key industry players is fostering technological advancements and market expansion. Joint ventures and strategic alliances enable companies to leverage each other’s strengths and resources.

- Partnerships with technology providers and research institutions drive innovation in OCTG product development.

Potential Opportunities

Exploration of Unconventional Resources

- Shale Gas and Tight Oil: Significant opportunities exist in North America and other regions with abundant shale reserves. The continued development of shale plays in the U.S. and Canada will drive OCTG demand.

- Deepwater and Ultra-Deepwater Projects: Growing investments in offshore exploration, particularly in regions like the Gulf of Mexico, Brazil, and West Africa, present substantial opportunities. These projects require advanced OCTG products capable of withstanding extreme conditions.

Technological Innovations

- Enhanced Oil Recovery (EOR) Techniques: Advancements in EOR methods, such as CO2 injection and chemical flooding, improve the recovery rate from existing fields, driving the need for specialized OCTG products.

- Smart Tubular Goods: The development of intelligent OCTG with embedded sensors for real-time monitoring and data collection is revolutionizing well operations. These products enhance safety, efficiency, and decision-making.

Expansion in Emerging Markets

- Asia-Pacific and Latin America: Increasing energy demand and the expansion of oil and gas infrastructure in emerging markets like Asia-Pacific and Latin America provide significant growth opportunities for the OCTG industry. These regions are witnessing increased investments in exploration and production activities, driven by the need for energy security and economic development.

Investment in Advanced Technologies

- Digitalization: Companies should invest in digital technologies such as IoT, AI, and big data analytics to enhance operational efficiency, reduce costs, and improve decision-making processes. Implementing predictive maintenance and real-time monitoring systems can significantly enhance the reliability and safety of OCTG products.

- Automation: Automating drilling and production processes can lead to significant cost savings and operational efficiencies. Companies should explore partnerships with technology providers to integrate automated solutions into their operations.

Focus on Sustainability

- Eco-Friendly Materials: Developing and adopting eco-friendly materials and coatings for OCTG products can help reduce the environmental impact of oil and gas operations. Companies should invest in research and development to create sustainable solutions that comply with stringent environmental regulations.

- Carbon Footprint Reduction: Implementing practices that reduce the carbon footprint of operations, such as optimizing logistics, improving energy efficiency, and adopting renewable energy sources, can enhance corporate sustainability profiles and meet regulatory requirements.

Expansion into Emerging Markets

- Market Penetration Strategies: Companies should develop targeted strategies to penetrate emerging markets in Asia-Pacific and Latin America. This includes establishing local partnerships, understanding regional regulatory frameworks, and tailoring products to meet specific market needs.

- Capacity Building: Investing in local manufacturing and service capabilities can help companies better serve emerging markets and reduce supply chain risks. Establishing training programs can also enhance local workforce skills and improve operational efficiencies.

Strategic Partnerships and Alliances

- Collaborative Innovation: Forming strategic partnerships with other industry players, technology providers, and research institutions can drive innovation and accelerate the development of advanced OCTG products. Joint ventures can also help companies share risks and resources.

- Supply Chain Resilience: Developing robust and flexible supply chains through strategic alliances with suppliers and logistics providers can mitigate the impact of disruptions and ensure the timely availability of raw materials and finished products.

Conclusion

The Oil Country Tubular Goods (OCTG) industry is poised for significant growth through 2023, driven by rising global energy demand, technological advancements, and increased investments in exploration and production activities. However, the industry also faces challenges such as volatile oil prices, stringent environmental regulations, and supply chain disruptions. By focusing on technological innovation, sustainability, strategic partnerships, and expansion into emerging markets, companies can capitalize on the opportunities and ensure long-term growth and resilience in the evolving energy landscape.

References

- International Energy Agency (IEA) Reports

- Rystad Energy Market Analysis

- American Petroleum Institute (API) Specifications

- Industry Reports and Market Research Publications

- Company Financial Reports and Strategic Plans

This in-depth analysis provides a comprehensive overview of the OCTG industry, highlighting key market drivers, challenges, segmentation, and potential growth areas. By leveraging the strategic recommendations outlined in this report, industry players can navigate the complex landscape and capitalize on emerging opportunities to drive future growth.